FACTOR MODELS

ABSTRACT

In this presentation, we give a quick survey of factor models. We describe how commercial models are built and how they can apply to commodities. This piece is intended to give a brief overview of the process, motivations and expectations of such models.

Introduction to Factor Models

Factor models are widely used in the investment management community to monitor risk and construct portfolios. There are many drivers of their development. One of the impetus behind factor models is to reduce the number of dimensions to compute the risk of portfolios with a large number of assets. Beyond the simple reduction in the number of risk factors, a model might help to focus a risk manager’s view on the broad themes in his or her book. A second driver is a stylized view of how asset markets should operate. In equities, for example, accounting ratios are one element assumed to have an effect in determining price movements. In many markets, there is no immediate liquidity for all assets. This is especially true in some mortgage, fixed income, credit or options market. A model helps the designated market maker offer a price to a prospective client with the knowledge that they have some rigorous basis for that mark.

In building a factor model, it is important to begin with a universe of factors that seems to affect the asset returns in that market. There are many ways to build such a set. Theory can give the researcher an a priori view about what types of variables might be admissible. Correlation and time series analysis can also suggest a set of variables which are related to the price returns of the assets in the universe.

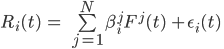

Assuming we have converged on a set of N factors, a factor model posits that asset returns must follow the linear relationship below:

| (1) |

Ri(t): Return of asset i for time period t | |

Fj(t): Return of factor j for time period t | |

βij: Factor loading (sensitivity of asset i’s return to factor i) | |

ε(t): Specific Return of asset i for period t |

All asset returns are driven by the same factors and a pure specific/idiosyncratic return unique to each asset. The loadings to each factor are different for each asset and time dependent. As discussed above, one of the attractive elements of these models is a reduction in dimensionality. Assets typically number in the thousands while factors are at least an order of magnitude lower. For example, equity models can cover asset universes of 10,000 with a factor set numbering 200. Historically models have been estimated monthly. They have migrated to weekly and now daily cycles. The user of the model must be clear on the time horizon for the return in Eq (1). The model is estimated with a very simple approach. First, the asset returns are measured for each period of time t. Fundamentally, the modeler must make a choice about what is known and what is to be estimated. There are 2 ways to estimate equation Eq (1):

Why a Factor Model for Commodities?

Commodities are hard assets that encompass agricultural, energy and metals based products. Commodities trading is as old as humanity and the first historical exchange is believed to be the Amsterdam Exchange [2]. In the US, the grandfather of commodities exchanges is the Chicago Board of Trades (CBOT) established in 1864 [3]. Today dozens of commodities are traded around the world in all sorts of variations.

There are many key features of futures contracts. First, they standardize what is often a heterogeneous product. This induces all sorts of delivery optionality. Second, the futures market standardizes expirations and so coordinates market behavior. Commodities futures invite both hedger activity as well as speculator/investor interest. Think, for example, of an airline that needs to hedge potential rising prices of jet fuel. The airline can find an active market for jet fuel as well as the crude feedstock. For instance, the crude oil contracts have monthly maturities for up to 10 years. This is more than adequate for most business planning horizons[4].

Commodities exhibit periods of extreme volatility, but evidence points to some premium that exceeds that volatility compensation. Recent literature [5] has demonstrated that commodity futures prices are influenced by a few common factors such as momentum, basis, liquidity, open interest. In many ways, there are parallels between equities and commodities. The difference, however, is that up to now, there is no commercially available commodity factor model. This is at odds with broader industry trends of extending factor models to other asset classes [6]. Commodities are an interesting asset class because they offer investors some correlation offset. As a result, they are valid instruments to include in an asset allocation portfolio.

We have found that commodity futures returns can be explained by a series of factors such as sectors and sub-sectors and a set of style factors such as risk premia and trading related factors. Under the lens of a commodity model, it becomes possible for the manager to spot hidden bets in their commodities book. We show that the factor model provides a better description of the risk of a portfolio composed of commodity futures and can help build portfolios for factors investing. Moreover, the use of a factor model frees the portfolio manager from the burden of worrying about expiration and maturity. By managing factor exposure, they can work in a more abstract, but understandable way.

The ARC Factor model uses the cross sectional (second) approach to modeling. We build a matrix of exposures consisting of membership in sectors and subsectors and exposures to thematic/style factors. A unique aspect of the ARC model is the nesting of subsectors into sectors. A manager may not care about subsector exposures, but might care about sector balance. The model’s calibration assures the manager that neither the risk nor factor performance will change. The same picture will emerge, whether up close or far away.

For more information see ARC Commodity Risk Factor Model Factsheet.

Two Approaches:

Time Series Approach-Factor Returns Exogenous - We know each factor return Fj(t) for period t and derive βij and ε(t) through a times series regression for each asset.

Cross Sectional Approach-Loadings are Exogenous - We know βij for each asset and we derive Fj(t) and ε(t) through cross-sectional regression (through all the assets for each period)

In the equity space, commercial vendors provide factor models using either approach. There are even vendors that offer models which blend the approaches.

Each approach has multiple implementations. A very popular way to handle time series models is to conduct Principal Component Analysis (PCA). This approach is often referred to as a statistical factors approach. The starting point is the correlation matrix of the assets’ returns, with the correlations computed over a period of time usually in years. The PCA technique will generate a set of principal components which are uncorrelated and a rotation matrix. Each asset will get a set of loadings to these uncorrelated and latent factors. The principal components are interpreted as long short portfolios of the underlying assets. Usually, a small number of factors (less than thirty) are enough to explain greater than 99% of the variance of the data. The drawback of the PCA approach is that the uncorrelated portfolios are not consistent day to day. Running a model serially can produce radically different portfolios day to day. Model vendors must use specialized versions of the PCA approach which condition on the previous day’s data in order that the model be consistent. A second approach to the time series models is much more direct and time series oriented. The researcher may have several thematic portfolios in his or her possession. Perhaps there are industry indexes or funds which purport to track value, momentum, liquidity, countries and so forth. The researcher can then regress the asset in his universe on the returns of these a priori identified portfolios. The perceived advantage of this approach is the easily identifiable and independent (of estimation technique) factor portfolios. The drawbacks are that the approach is rife with ad hoc choices. The factor portfolios or indices may be independent of the estimation technique, but they may not be statistically independent.The time series regression will yield ambiguous results.

Cross sectional models proceed with an identification of important types of exposures for the asset universe. In the case of equity, the types of exposures can be boiled down to exposures to common factors such as sectors, industries or countries (for global models) and a series of style factors. The sectors, industries, countries factors play the role of market factors. They are either dummy indicators of inclusion in a sector or they are real valued and run from 0 to 1. A firm might be 0.6 consumer nondurables and 0.35 consumer staples and 0.05 defense, for instance. Style factors are made up of premia factors and trading related factors. For equity, premia factors are typically associated with the fundamentals of a company. These types of models are often referred to as fundamental factor models. Risk premia factors should provide returns to investors who are willing to take an identified risk. For instance, value investors will look at price to book and price to earnings ratios of companies and select stocks with lower ratios, hoping to be rewarded as these stocks will appreciate over time. Other typical factors include momentum, size, quality, low volatility. Trading related factors include liquidity.

The construction of the cross sectional models begins with the identification of the universe of tradable assets and the collection of data which can be used to create exposures or loadings to the universe of factors. In the now familiar case of equities, data on companies’ industrial participation, sales, book value and so forth is collected. The data is normalized. The returns of the assets are regressed on the exposure data (which is transformed to z-scores). This regression results in a set of estimated factor returns. The critical aspect of this approach is that the factor returns are determined endogenously by the returns of the assets and the level of exposures. With factor returns in hand, it is possible to construct pure factor replicating portfolios. These are theoretical portfolios (often spanning the entire set of assets) which are not directly useful-though indicative. However, using the information from these factor replicating portfolios and the exposure file, one can construct portfolios with a tilt towards these factors. This process is now called factor investing and is part of the offering of most large asset managers.

We refer to [1] for an exhaustive description and discussion of techniques and approaches.

Whatever the approach chosen for the modeling of the asset universe, all of these models yield a set of exposures to factors, a covariance matrix of factors, and a set of factor returns. Using this information, one can generate estimates of portfolio variance and volatility as well as calculate Value at Risk (VaR) or other forms of portfolio analytics and attribution.

REFERENCES

Richard Grinold and Ronald Kahn (1999). Active Portfolio Management: A Quantitative Approach for Producing Superior Returns and Controlling Risk (McGraw-Hill Education)

Lodewijk Petram. “The World’s First Stock Exchange” (Columbia Business School Publishing), 2014.

William G. Ferris (1988). The Grain Traders: The Story of the Chicago Board of Trade. (East Lansing, MI: Michigan State University Press, 223 p.)

Heskett, James L., and W. Earl Sasser Jr. "Southwest Airlines: In a Different World." Harvard Business School Case 910-419, April 2010. (Revised January 2013.)

Athanasios Sakkas, Nikolaos Tessaromatis (2018). “Factor Based Commodity investing”, Edhec Business School.

Clifford S. Asness, Tobias J. Moskowtiz,, and Lasse Heje Pedersen. “Value and Momentum Everywhere”. The Journal of Finance • Vol. LXVIII, No. 3 • June 2013